Small Business Learning Center

Apply for a Merchant Cash Advance; Being Prepared

In the competitive arena of small and medium-sized enterprises (SMEs), swift and flexible financial solutions are often the key to leveraging growth opportunities or navigating rough patches. A Merchant Cash Advance (MCA) has become a go-to option for businesses seeking quick access to funds without the hurdles of traditional bank loans. This funding approach, however, [...]

How to Get Business Credit Fast: Effective Strategies

Building business credit quickly is a critical step for entrepreneurs seeking financial flexibility and growth opportunities. A strong business credit profile opens doors to better loan terms, increased financing options, and improved business relationships. This article outlines practical and efficient methods to build business credit swiftly, ensuring your business is well-positioned for success. Establishing Your [...]

Best Small Business Equipment Loans

For small businesses, acquiring the right equipment can be a game-changer, enabling efficiency, growth, and competitive edge. However, the challenge often lies in funding these crucial purchases. The best equipment loans emerge as a solution, allowing businesses to finance these essential assets. This article explores the best equipment loan options for small businesses, helping entrepreneurs [...]

Business Line of Credit Without Credit Checks

Securing a business line of credit is a critical financial maneuver for many companies. Often, the process involves credit evaluations, which can be a hurdle for businesses with less-than-stellar credit histories. This comprehensive exploration delves into the world of business lines of credit that purportedly do not require credit checks, uncovering the truths, myths, and [...]

Typical Small Business Loan Rates: An In-Depth Guide

One critical aspect of this process is understanding the typical interest rates associated with these loans. This guide aims to demystify small business loan rates, providing detailed insights to help business owners make informed financial decisions when seeking funding. Importance of Loans for Business Growth Access to capital through loans is essential for small businesses, [...]

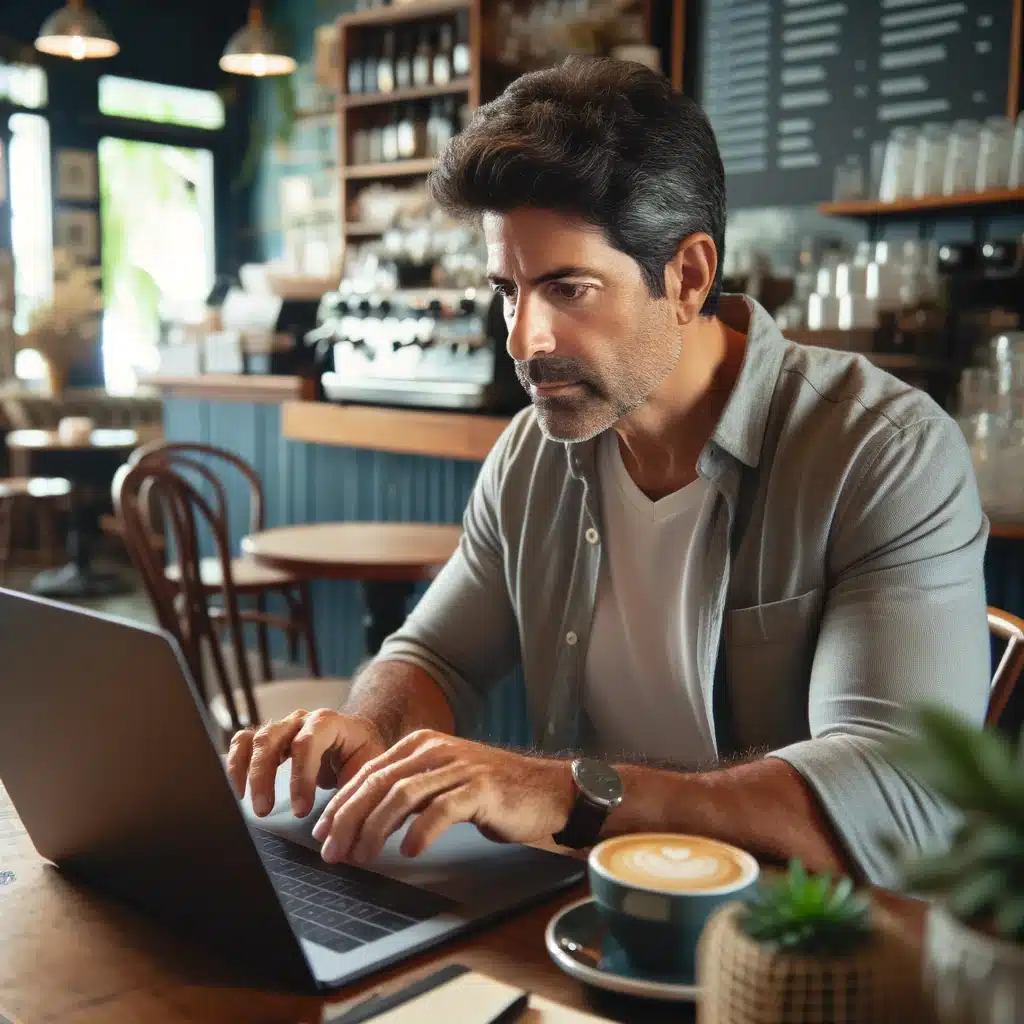

Café Business Loans

The café industry, with its unique blend of hospitality and retail, offers exciting opportunities for entrepreneurs. However, launching or expanding a café often requires significant financial investment. This guide is designed to help café owners navigate the complexities of securing business loans, offering insights into various financing options and practical advice for successful applications. Understanding [...]

Hispanic-Owned Small Business Loans & Credit Lines

Hispanic-owned small businesses are burgeoning in the United States, contributing significantly to local economies and communities. Despite this growth, these businesses often encounter unique challenges in securing funding. This guide aims to illuminate the path to obtaining loans and lines of credit, crucial for the expansion and sustainability of Hispanic-owned enterprises. Understanding the Landscape for [...]

Guaranteed Business Loans with No Credit Check

In the world of business financing, the allure of guaranteed loans without a credit check is strong, particularly for entrepreneurs grappling with credit challenges. This article aims to dispel the myth surrounding such loans, emphasizing that in the realm of legitimate finance, guarantees of approval without due diligence are virtually non-existent. We will also explore [...]

What Is a Business UCC Filing?

Navigating the complexities of commercial transactions and maintaining healthy creditor relationships are fundamental aspects of running a successful business. Central to these processes in the United States is the concept of the Uniform Commercial Code (UCC) filing. Despite its importance, many business owners find themselves unclear about what UCC filings entail and how they impact [...]