Every thriving small business reaches a point where growth is limited not by market opportunity or customer outreach but by something as simple as inventory. Whether you’re running a boutique, a hardware store, or a small manufacturing unit, having the right amount of stock to meet customer demands is crucial in maintaining your business’s success. However, one of the most significant challenges that small business owners face is financing the purchase of inventory. This comprehensive guide explores how small business loans can be a viable solution for managing inventory purchase, ensuring that businesses can meet demand without compromising their financial health.

Understanding the Importance of Inventory for Small Businesses

Inventory, whether in the form of raw materials, work-in-progress, or finished goods, represents a substantial investment from business owners. It is an essential component that keeps the business cycle running, ensuring that customers receive their products on time. However, inventory also ties up a significant portion of a business’s liquid assets, often creating a financial strain. Too little inventory can lead to lost sales, unsatisfied customers, and a tarnished brand reputation. Conversely, too much inventory can lead to increased costs for storage, maintenance, and, ultimately, financial losses if the items can’t be sold.

The Role of Small Business Loans in Inventory Management

Cash flow constraints should not hinder your ability to stock adequately. This is where small business loans come in. Unlike traditional loans, these are typically easier to obtain, have shorter repayment terms, and are more suited to urgent, less substantial financial needs. Here’s how the right loan can aid your inventory management:

- Maintaining Optimal Inventory Levels: With the financial backing from a loan, you can maintain the stock needed to meet your customers’ current demands without depleting your operational funds.

- Capitalizing on Bulk Purchase Discounts: Suppliers often offer discounts for bulk purchases. A loan can provide you with the upfront cash needed to take advantage of these discounts, ultimately saving money in the long run.

- Preparing for Seasonal Sales Fluctuations: Many businesses have peak seasons. A small business loan ensures you can prepare for these busy periods by purchasing the necessary inventory ahead of time.

- Expanding Product Lines: If you’re looking to introduce new products but lack the funds for the initial investment in these additional inventories, a small business loan can help cover the initial outlay.

Types of Small Business Loans for Purchasing Inventory

Several types of loans cater specifically to the needs of small businesses:

- Term Loans: Traditional term loans provide a lump sum that you pay back, with interest, over a set period. These loans are often used for specific investment purposes, such as buying inventory.

- Lines of Credit: Business lines of credit offer access to funds up to a certain limit. You only pay interest on the money you use and can draw and repay funds as needed. This option is excellent for managing ongoing inventory needs.

- Short-Term Loans: These loans are similar to traditional term loans but have shorter repayment periods, usually less than a year. They’re beneficial for quick inventory purchases needed to capitalize on sudden market opportunities.

- SBA Loans: Small Business Administration (SBA) loans are government-backed loans that offer favorable terms and rates. They can be used for various purposes, including purchasing inventory, though they might have a more rigorous approval process.

- Inventory Financing: This is a specific type of loan used against your inventory serving as collateral. It’s an ideal option if you need funds solely for inventory purchase.

Considerations Before Applying for a Loan

Before you apply for a small business loan, consider the following factors to ensure you’re choosing the right financing option for your inventory needs:

- Financial Analysis: Conduct a thorough analysis of your current financials. Understand your turnover rates, the cost of goods, and identify the amount of funding you need.

- Repayment Capacity: Assess your business’s profitability and cash flow to ensure you can meet the repayment terms.

- Market Demand: Analyze market trends and demand forecasts for your products. Purchasing inventory should be based on clear data indicating that your stock will sell.

- Loan Terms: Be mindful of interest rates, loan tenure, and terms of repayment. Ensure these factors are in sync with your business capabilities and financial health.

- Alternative Strategies: Consider other management techniques, such as drop shipping or Just-In-Time (JIT) inventory, that might require less upfront capital before committing to a loan.

List of Inventory Small Businesses Might Purchase

The type you purchase is inherently tied to your specific industry. Below is a list of potential inventory types across different sectors:

Retail Businesses:

- Clothing and accessories

- Electronics and appliances

- Furniture and home decor

- Health and beauty products

- Sporting goods

- Books, toys, and games

Manufacturing Businesses:

- Raw materials

- Machinery parts

- Manufacturing supplies

- Packaging materials

Construction Businesses:

- Building materials (e.g., lumber, concrete, bricks)

- Hardware and tools

- Electrical and plumbing supplies

- Landscaping supplies

Restaurants and Catering Services:

- Perishable and non-perishable food

- Cooking supplies and utensils

- Cleaning supplies

- Tableware and linens

Healthcare Businesses:

- Medical supplies

- Pharmaceuticals

- Health and wellness products

- Medical devices

What Are the Benefits of Using a Business Loan to Purchase Inventory?

Utilizing a loan offers numerous advantages that can significantly enhance operations and profitability. Here are some key benefits:

1. Improved Cash Flow Management

Securing a loan for inventory helps maintain a healthy cash flow by freeing up capital for other operational expenses like payroll, marketing, and rent. This ensures you can cover essential costs without financial strain.

2. Taking Advantage of Bulk Purchasing Discounts

Loans enable bulk purchasing, which often comes with significant discounts from suppliers. This can reduce the cost per unit and increase profit margins, providing a competitive edge in pricing and profitability.

3. Preventing Stockouts

Having sufficient inventory on hand ensures that you can meet customer demand without delay. This prevents stockouts, enhances customer satisfaction, and can lead to repeat business, as customers are more likely to return when they know you reliably have products in stock.

4. Preparing for Seasonal Demand

For those with seasonal sales peaks, loans can help purchase additional inventory to prepare for high-demand periods. This enables you to maximize sales opportunities during these times, ensuring you have enough stock to meet increased customer demand.

5. Improving Supplier Relationships

Prompt and large orders made possible by inventory loans can help build stronger relationships with suppliers. Reliable suppliers might offer better terms, discounts, or priority service in the future, enhancing your supply chain stability and cost-efficiency.

6. Supporting New Product Launches

When introducing new products, having the capital to invest in adequate inventory ensures that you can meet initial demand and market the new offerings effectively. This can be crucial for capturing market share and establishing new revenue streams.

7. Enhancing Competitive Edge

With adequate inventory, you can respond swiftly to market changes and customer needs, giving you a competitive edge over others who might struggle with stock issues. This agility can be a significant advantage in maintaining and growing your market position.

How Do Different Types of Business Inventory Loans Compare?

Inventory loans come in various forms, each with unique features, benefits, and drawbacks. Here’s a detailed comparison:

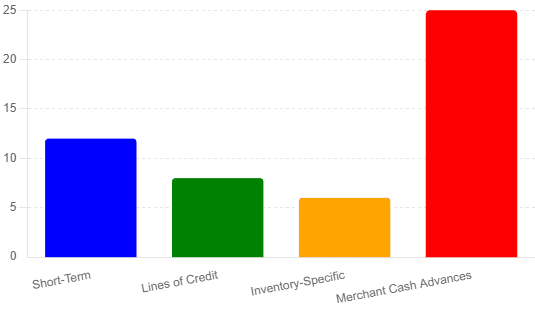

1. Short-Term Loans

Features: Provide a lump sum that must be repaid within a short period, typically 3 to 18 months.

Benefits:

- Quick access to cash, often within a few days.

- Fixed repayment schedule, making budgeting easier.

- Can be used for immediate inventory needs without long-term commitment.

Drawbacks:

- Higher interest rates compared to long-term loans.

- Significant cash flow impact due to the short repayment period.

- May require a strong credit score or collateral.

2. Lines of Credit

Features: Flexible funding that can be drawn upon as needed, up to a predetermined limit.

Benefits:

- Only pay interest on the amount used.

- Can be reused as funds are repaid, providing ongoing access to capital.

- Typically easier to manage for fluctuating inventory needs.

Drawbacks:

- Variable interest rates can make budgeting challenging.

- Possible annual or maintenance fees, which add to the cost.

- May require a solid credit history and financial documentation.

3. Inventory-Specific Financing

Features: Uses existing inventory as collateral to secure the loan.

Benefits:

- Easier to qualify for if you have valuable inventory.

- Typically lower interest rates due to collateral.

- Allows businesses to leverage inventory assets without depleting cash reserves.

Drawbacks:

- Risk of losing inventory if unable to repay the loan.

- Loan amount limited to a percentage of the inventory’s value.

- Regular audits or inspections of inventory might be required by the lender.

4. Merchant Cash Advances

Features: Provides an advance on future sales, repaid through a percentage of daily credit card receipts.

Benefits:

- Quick access to funds, often within 24 to 48 hours.

- Flexible repayment aligned with sales volume, easing cash flow management.

- Less emphasis on credit score, focusing more on sales performance.

Drawbacks:

- High costs, often with APRs significantly higher than traditional loans.

- Repayment structure can impact cash flow if sales are lower than expected.

- Can create a cycle of dependency, where businesses rely on advances to cover expenses.

Choosing the Right Option

Selecting the right type of inventory financing depends on factors such as your cash flow, the value of your inventory, and your ability to manage repayments. Understanding these differences can help you make an informed decision that best suits your financial situation and operational needs.

By carefully evaluating each option’s benefits and drawbacks, you can choose the inventory financing solution that aligns best with your goals and capabilities, ensuring a sustainable approach to managing your stock and capital.

This bar chart compares the interest rates for different types of loans, illustrating the cost differences.

What Are the Risks Associated with Inventory Loans?

While inventory loans can be a valuable tool for maintaining stock levels and meeting customer demand, they come with several risks that should be considered:

1. High-Interest Rates

Inventory loans, especially short-term ones, often come with higher interest rates compared to traditional loans. These higher rates can increase the overall cost of borrowing, potentially impacting profitability.

2. Impact on Cash Flow

Regular repayments can strain cash flow, particularly if sales do not meet expectations. It is crucial to ensure there is sufficient cash flow to cover loan repayments without compromising other operational expenses.

3. Risk of Over-Leverage

Access to easy financing can lead to over-leverage, where more debt is taken on than can be handled. This can increase financial risk and potentially lead to insolvency if not managed carefully.

4. Collateral Risk

For inventory-specific financing, the inventory itself is used as collateral. If the loan cannot be repaid, there is a risk of losing the purchased stock, which can disrupt operations and sales.

5. Dependency on Sales Performance

Some inventory loans, like merchant cash advances, are repaid based on future sales. If sales decline, it might be difficult to meet repayment obligations, leading to financial stress.

6. Market Fluctuations

Market demand can be unpredictable. Investing heavily in inventory through loans carries the risk that the products may not sell as expected, leading to excess stock and financial losses.

7. Credit Score Impact

Missing repayments or defaulting on an inventory loan can negatively affect the credit score, making it more difficult to secure financing in the future.

How to Mitigate Risks

- Thorough Planning: Conduct market research to accurately forecast inventory needs and ensure there is sufficient demand for the products.

- Financial Management: Maintain strong financial controls to ensure cash flow can support loan repayments.

- Diversification: Avoid relying solely on loans for inventory; consider other financing options and maintain a balanced financial strategy.

- Contingency Plans: Develop plans to address potential sales declines or market changes to manage repayments effectively.

Understanding and planning for these risks can help leverage the benefits of inventory loans while minimizing potential downsides.

Can Inventory Loans Be Used for Seasonal Purchases?

Yes, inventory loans can be an excellent solution for managing seasonal needs. Here’s how they can help:

1. Managing Cash Flow

Seasonal businesses often experience fluctuations in cash flow. Inventory loans provide the necessary capital to purchase ahead of peak seasons without straining cash reserves.

2. Taking Advantage of Seasonal Discounts

Suppliers often offer discounts on bulk purchases before peak seasons. Inventory loans allow businesses to take advantage of these discounts, reducing the overall cost of goods.

3. Meeting Customer Demand

Ensuring sufficient inventory during high-demand periods is crucial for maintaining customer satisfaction. Inventory loans help stock up on popular items, preventing stockouts and lost sales.

4. Flexibility

Inventory loans offer flexibility in terms of loan amounts and repayment schedules, allowing businesses to align repayments with their revenue cycles. This ensures that loans can be repaid during the high-revenue periods that follow the peak seasons.

5. Maintaining Competitive Edge

Having adequate stock during peak seasons enables businesses to meet customer demands promptly, enhancing their reputation and competitive edge in the market.

Key Considerations

- Interest Rates and Fees: Consider the cost of borrowing, including interest rates and additional fees. Ensure that increased revenue during peak seasons will cover these costs.

- Repayment Terms: Align repayment terms with revenue cycles to help manage cash flow. Some lenders may offer flexible repayment schedules tailored to seasonal businesses.

- Loan Amounts: Assess the required loan amount carefully to avoid over-borrowing, which can lead to unnecessary debt.

How to Apply

To apply for an inventory loan for seasonal purchases, typically you need to:

- Provide Financial Statements: Demonstrate financial health and ability to repay the loan.

- Show Seasonal Sales Data: Highlight past sales data to show the seasonal nature of the business and forecast future sales.

- Prepare a Solid Business Plan: Outline how the loan will be used and the expected return on investment.

By preparing these documents and choosing a lender that understands the seasonal nature of your business, you can secure the financing needed to thrive during peak seasons.

How Do Lenders Evaluate the Value of Inventory?

When considering inventory loans, lenders assess the value to determine the loan amount and terms. Here are the key steps and factors involved in the evaluation process:

1. Type

Lenders first categorize the inventory. They typically prefer items with high turnover rates, such as consumer goods, over perishable or highly specialized items. High turnover items indicate a quicker conversion to cash, which reduces risk for the lender.

2. Age

Older inventory is often valued less due to potential obsolescence. Lenders prefer inventory that is current and in demand. Stock that moves quickly is seen as less risky and more valuable as collateral.

3. Quality

The condition and quality of inventory play a crucial role. Well-maintained, undamaged, and marketable items are valued higher. Lenders assess whether the inventory is new, used, or refurbished, and whether it is in a condition that can be easily sold.

4. Market Value

Lenders assess the current market value of the inventory. This involves understanding the selling price and demand for the items in the marketplace. They may look at industry reports, current sales data, and trends to estimate the inventory’s market value accurately.

5. Turnover Rate

High turnover rates indicate that the inventory sells quickly, which is favorable for lenders as it suggests it can be converted into cash easily. Lenders prefer inventory that doesn’t sit in storage for long periods as it reduces the risk of obsolescence and depreciation.

6. Financial Documentation

Lenders require detailed financial documentation, including stock lists, purchase invoices, sales records, and management reports. This helps verify the inventory’s value and turnover rate. Accurate and up-to-date records improve the lender’s confidence in its value.

7. Appraisal

In some cases, lenders may require a professional appraisal to determine the accurate value of the inventory. This provides an objective valuation, ensuring that both the lender and borrower have a clear understanding of the inventory’s worth. Appraisers assess the condition, market demand, and other factors affecting value.

8. Risk Assessment

Lenders assess the risk associated with the inventory, considering factors like market stability and the borrower’s sales performance. They evaluate whether the inventory is prone to price fluctuations or is in an industry subject to rapid changes, which can impact the collateral value.

What Happens if the Inventory Financed by the Loan Does Not Sell?

If the inventory financed by the loan does not sell, several consequences and actions may arise:

1. Cash Flow Strain

Impact: The business may experience cash flow issues as revenue from inventory sales is not realized, making it challenging to meet loan repayments.

Solution: Implement a more aggressive marketing strategy or offer discounts to move inventory quickly.

2. Repayment Difficulties

Impact: Difficulty in making loan repayments can lead to missed payments, late fees, and potential default.

Solution: Negotiate with the lender for revised payment terms or seek alternative financing to cover loan repayments.

3. Impact on Credit Score

Impact: Missed or late payments can negatively affect the credit score, making it harder to secure future financing.

Solution: Maintain open communication with the lender and address repayment issues promptly.

4. Liquidation

Impact: Lenders may require the liquidation of unsold inventory to recover the loan amount, which can be at a loss if it is sold below cost.

Solution: Consider liquidation sales or partnering with discount retailers to sell off excess inventory.

5. Risk of Collateral Seizure

Impact: If the loan is secured by inventory as collateral, the lender may seize the inventory to recover the debt.

Solution: Diversify collateral to avoid putting all inventory at risk and negotiate flexible terms with the lender.

6. Operational Adjustments

Impact: Unsold inventory may necessitate operational changes, such as reducing order sizes or shifting focus to more popular products.

Solution: Analyze sales data to adjust strategies and align with customer demand.

7. Strategic Reassessment

Impact: The business might need to reassess its product offerings and market strategy to avoid future issues.

Solution: Conduct thorough market research to understand trends and adjust product lines accordingly.

Frequently Asked Questions About Inventory Loans

1. What is the typical loan-to-value ratio?

The loan-to-value ratio for inventory loans usually ranges from 50% to 80% of the value, depending on the lender and the type of inventory.

2. Can I use an inventory loan to purchase new stock or only existing stock?

Inventory loans can be used for both purchasing new stock and leveraging existing stock, providing flexibility in managing inventory needs.

3. How long does it take to get approved for an inventory loan?

Approval times vary, but most lenders can process applications and provide funding within a few days to a couple of weeks, depending on the completeness of the documentation.

4. Are there specific industries that benefit more from inventory loans?

Industries with high turnover rates and consistent demand, such as retail, e-commerce, and manufacturing, benefit most from inventory loans due to their constant need for replenishing stock.

5. What are the repayment terms?

Repayment terms for inventory loans can range from a few months to several years, depending on the loan amount, the lender, and the specific agreement.

6. Do inventory loans require personal guarantees?

Some inventory loans may require personal guarantees, especially if the business is new or lacks substantial credit history. This provides additional security for the lender.

7. Can inventory loans help improve my business credit score?

Yes, timely repayments on inventory loans can help improve your business credit score, making it easier to secure future financing.

8. What happens if my stock value fluctuates?

If the value fluctuates significantly, the lender might reassess the loan terms, which could include adjusting the loan amount or requiring additional collateral.

9. Are there alternatives to inventory loans for financing stock?

Alternatives include lines of credit, trade credit from suppliers, and merchant cash advances, each with its own terms and benefits.

10. What are the common fees associated?

Common fees include origination fees, appraisal fees, and sometimes maintenance fees, all of which should be considered when calculating the total cost of the loan.

Pros and Cons of Inventory Loans

Pros

- Improved Cash Flow: Access to funds without depleting cash reserves, allowing for smoother operations and financial flexibility.

- Bulk Purchase Discounts: Enables bulk buying, often leading to significant discounts from suppliers, reducing per-unit costs.

- Meeting Demand: Ensures adequate stock levels to meet customer demand, preventing stockouts and lost sales.

- Flexibility: Offers flexible terms and repayment schedules tailored to business needs, aligning with revenue cycles.

- Building Supplier Relationships: Facilitates larger and timely orders, potentially leading to better terms and priority service from suppliers.

Cons

- High-Interest Rates: Often comes with higher interest rates compared to traditional loans, increasing overall borrowing costs.

- Cash Flow Strain: Regular repayments can strain cash flow, especially if sales do not meet expectations.

- Over-Leverage Risk: Easy access to loans can lead to taking on excessive debt, increasing financial risk.

- Collateral Risks: If the loan is secured, failure to repay can result in the loss of valuable assets.

- Market Fluctuations: Unpredictable market demand can lead to excess stock and financial losses if products do not sell as expected.

Conclusion: Strategizing for Success

Investing in inventory is a critical decision for any small business. With the right approach, a small business loan can be a strategic tool rather than just a financial obligation. It’s essential to understand your market demand, assess your financial health, and consider the loan’s terms before diving in. By doing so, you can maintain the delicate balance between meeting customer demand and maintaining healthy financial liquidity, propelling your business toward sustained growth and success. Remember, the goal is not just to purchase inventory but to do it strategically to strengthen your market position and enhance profitability.